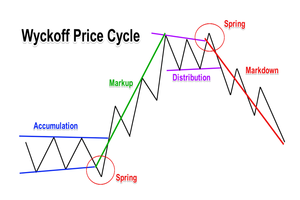

The Wyckoff Method – Price Cycle

The Wyckoff Method is a technical analysis approach in trading that was developed by Richard D. Wyckoff, a stock trader and market theorist in the late 19th and early 20th centuries.

It is based on the idea that price and volume patterns can provide insight into the supply and demand dynamics in the market, and can be used to identify potential trade setups.

The method is based on four key principles:

- Market structure: The market consists of different phases, including accumulation, mark-up, distribution, and mark-down.

Each phase is characterized by specific price and volume patterns, which can be identified through chart analysis.

- Cause and effect: Price movements in the market are caused by the actions of market participants, such as traders and investors.

By analyzing these actions, it is possible to predict future price movements. - Supply and demand: The supply and demand for a particular security determines its price.

By analyzing the supply and demand dynamics in the market, it is possible to identify potential trade setups. - Composite man: The composite man is a hypothetical market participant that represents the collective actions of all market participants.

By analyzing the actions of the composite man, it is possible to gain insight into the overall sentiment and direction of the market.

The Wyckoff Trading Method involves analyzing price and volume patterns on charts, and using this information to identify potential trade setups.

It is a subjective approach, and requires the trader to have a good understanding of chart analysis and market dynamics.

This post is NOT investment advice.

************