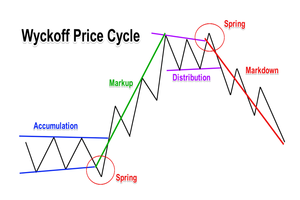

The Wyckoff Method: The Wyckoff Trading Cycle

- Accumulation: During the accumulation phase, the market is in a downtrend and prices are generally trending downward. This is typically a good time for smart money (e.g. institutional investors) to start accumulating a security. In this phase, you may see the following price and volume patterns:

- Price may be consolidating in a narrow range, forming a trading range or base.

- Volume may be declining, indicating a lack of interest in the security.

- There may be tests of support and resistance levels, as buyers and sellers battle for control of the market.

- Mark-up: The mark-up phase is characterized by an uptrend in prices, as the smart money starts to push the price higher. In this phase, you may see the following price and volume patterns:

- Price may start to breakout from a trading range or base, and trend higher.

- Volume may start to increase, indicating increased interest in the security.

- There may be a series of higher highs and higher lows, as buyers continue to dominate the market.

- Distribution: The distribution phase is characterized by a downtrend in prices, as the smart money starts to sell off its positions. In this phase, you may see the following price and volume patterns:

- Price may start to trend downward, and may break below support levels.

- Volume may increase significantly, indicating increased selling activity.

- There may be a series of lower lows and lower highs, as sellers dominate the market.

- Mark-down: The mark-down phase is characterized by a strong downtrend in prices, as the market enters a bearish phase. In this phase, you may see the following price and volume patterns:

- Price may continue to trend downward, breaking below key support levels.

- Volume may remain high, indicating ongoing selling activity.

- There may be a lack of buying interest, as the market becomes increasingly bearish.

These are just some of the price and volume patterns that may be seen in each phase of the market. It’s important to note that these patterns are not always easy to spot, and may require careful analysis and interpretation.

In the Wyckoff Trading Method, the market is divided into four main phases: accumulation, mark-up, distribution, and mark-down.

Each phase is characterized by specific price and volume patterns that can be identified through chart analysis.

This post is NOT investment advice.

************